Property Ownership Basics

Master the fundamental concepts of property ownership, including types of ownership, estates in real property, and how property rights work in California real estate.

Property Ownership Basics

Master property ownership fundamentals with free flashcards and spaced repetition practice. This lesson covers types of ownership, estates in real property, and property rights—essential concepts for passing the California Real Estate Salesperson Exam. Understanding these basics forms the foundation for everything else you'll learn in real estate, from contracts to agency relationships.

Welcome to Your Real Estate Journey! 🏡

Welcome to your first lesson in California real estate! Property ownership might sound complicated, but we'll break it down into simple, understandable pieces. Think of property ownership like a bundle of sticks—each stick represents a different right you have with property (the right to use it, sell it, lease it, etc.). By the end of this lesson, you'll understand exactly what these rights are and how different types of ownership work.

The CalBRE exam requires you to score 70% or higher on 150 questions, and property ownership concepts appear throughout the test. Let's build your confidence from the ground up!

Core Concepts: Understanding Property Ownership

What is Real Property? 🏘️

Real property (also called "real estate" or "realty") includes:

- Land: The surface of the earth

- Attachments to land: Buildings, trees, minerals

- Air rights: The space above the land

- Subsurface rights: Minerals, oil, gas below the surface

Think of it this way: If you buy a house, you're not just buying the building—you're buying the land it sits on, the air space above it (within limits), and potentially what's underneath it!

Personal property ("personalty"), on the other hand, is movable. Your furniture, car, and clothing are personal property.

💡 Memory Tip: REAL property is REALLY attached to the earth—you can't easily move it!

The Bundle of Rights 🎁

When you own property, you receive a "bundle of rights." These are:

| Right | What It Means | Example |

|---|---|---|

| Possession | Right to occupy the property | Living in your home |

| Control | Right to determine how property is used | Deciding to paint your house blue |

| Enjoyment | Right to use property without interference | Having peace and quiet in your home |

| Exclusion | Right to keep others off the property | Posting "No Trespassing" signs |

| Disposition | Right to sell, lease, or transfer | Selling your house or renting it out |

🧠 Mnemonic: Remember PECED (sounds like "peace-ed") = Possession, Enjoyment, Control, Exclusion, Disposition

Estates in Real Property 📜

An estate describes the degree, quantity, nature, and extent of interest a person has in real property. Think of it as "how much ownership" you have and "for how long."

Freehold Estates (Ownership)

These are ownership estates that last for an indefinite period:

1. Fee Simple Absolute (Fee Simple Estate)

- The highest and best form of ownership

- Lasts forever (perpetual)

- Owner has ALL rights in the bundle

- Can be inherited

- Most common type of ownership in California

2. Fee Simple Defeasible

- Ownership with conditions or restrictions

- If condition is violated, ownership can be lost

- Example: "I grant this land to the city AS LONG AS it's used as a park"

- If the city builds condos instead, ownership could revert to the original owner

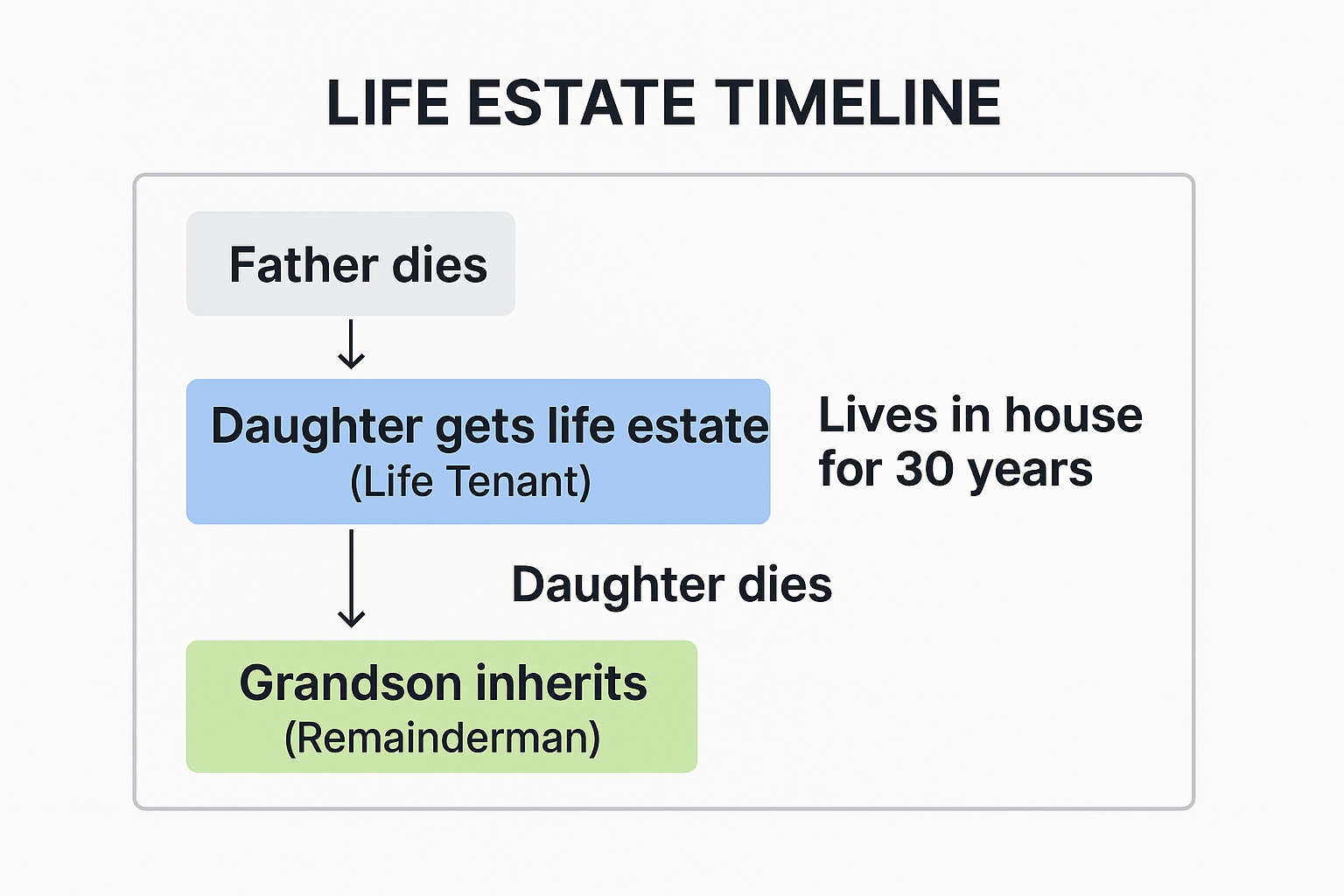

3. Life Estate

- Ownership lasts only for someone's lifetime

- When that person dies, property passes to someone else

- Example: Father leaves house to daughter "for her lifetime," then to grandson

- The daughter is the life tenant (has ownership during her life)

- The grandson is the remainderman (gets property after life tenant dies)

View original ASCII

LIFE ESTATE TIMELINE👴 Father dies │ ↓ 👩 Daughter gets life estate ──→ Lives in house for 30 years (Life Tenant) │ │ Daughter dies ↓ 👨 Grandson inherits (Remainderman)

Leasehold Estates (Possession without ownership)

These give you the right to possess and use property, but not own it:

- Estate for Years: Lease with specific start and end dates ("1-year lease")

- Periodic Tenancy: Automatically renews ("month-to-month lease")

- Estate at Will: Can be terminated by either party anytime

- Estate at Sufferance: Tenant stays after lease expires (holding over)

Types of Property Ownership 👥

How you hold title (legal ownership) matters for taxes, inheritance, and liability.

Ownership in Severalty

Severalty = One owner (individual or entity)

- Despite the name, it means ownership by ONE person/entity

- "Severed" from others = separate, sole ownership

- Example: John Smith owns a house by himself

💡 Confusing Name Alert: "Severalty" sounds like "several people," but it means the OPPOSITE—just ONE owner!

Concurrent Ownership (Co-ownership)

When two or more people own property together:

1. Tenancy in Common (TIC)

- Each owner has an undivided interest (percentage of the whole)

- Interests can be unequal (one person owns 60%, another 40%)

- Each owner can sell their share without permission

- When an owner dies, their share goes to their heirs (not other co-owners)

- Default form of co-ownership in California for non-married people

📋 Tenancy in Common Example

Three friends buy a rental property:

- Alice owns 50%

- Bob owns 30%

- Carol owns 20%

Alice can sell her 50% share to David without asking Bob or Carol. If Carol dies, her 20% goes to her children (via her will or intestate succession), NOT to Alice and Bob.

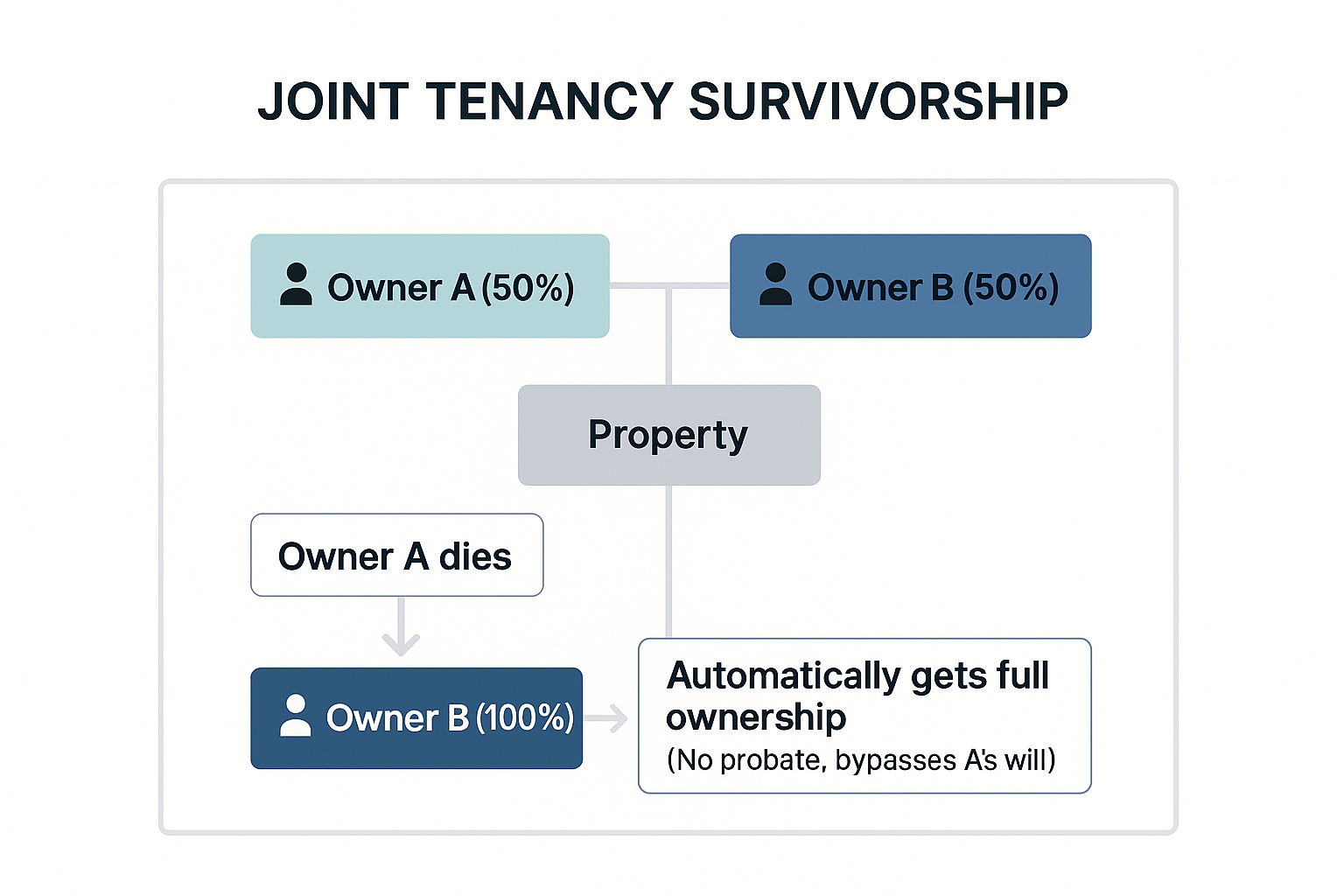

2. Joint Tenancy (JTROS - Joint Tenancy with Right of Survivorship)

- All owners have equal shares

- Requires Four Unities: Time, Title, Interest, Possession (T-TIP)

- Most important feature: Right of Survivorship

- When one owner dies, their share automatically goes to surviving joint tenants

- Does NOT pass through a will or probate

- Can be broken if one owner sells their share

| The Four Unities (T-TIP) | What It Means |

|---|---|

| Time | All owners acquire interest at the same time |

| Title | All owners acquire interest in the same deed |

| Interest | All owners have equal shares (50-50, 33-33-33, etc.) |

| Possession | All owners have equal right to possess entire property |

🧠 Mnemonic: T-TIP = Time, Title, Interest, Possession (needed for Joint Tenancy)

View original ASCII

JOINT TENANCY SURVIVORSHIP👤 Owner A (50%) ────┐ ├─→ Property 👤 Owner B (50%) ────┘

Owner A dies ❌ │ ↓ 👤 Owner B (100%) ───→ Automatically gets full ownership (No probate, bypasses A's will)

3. Community Property (Married Couples in California)

- California is a community property state

- Property acquired during marriage is presumed community property

- Each spouse owns 50%

- When one spouse dies, their 50% goes per their will (or to spouse if no will)

- Property owned before marriage or received as gift/inheritance is separate property

4. Community Property with Right of Survivorship

- Combines community property with automatic survivorship

- Must be explicitly stated in the deed

- When one spouse dies, survivor automatically gets 100%

- Avoids probate like joint tenancy

| Ownership Type | Equal Shares? | Right of Survivorship? | Common Use |

|---|---|---|---|

| Tenancy in Common | ❌ No | ❌ No | Business partners, investors |

| Joint Tenancy | ✅ Yes | ✅ Yes | Family members, close partners |

| Community Property | ✅ Yes (50-50) | ❌ No | Married couples (California) |

| Community Property w/ ROS | ✅ Yes (50-50) | ✅ Yes | Married couples wanting to avoid probate |

Examples with Explanations 🎯

Example 1: Understanding Life Estates

Scenario: Margaret owns a house in fee simple absolute. In her will, she leaves the house to her daughter Susan "for life," then to her grandson Tommy.

What happens?

- When Margaret dies, Susan becomes the life tenant

- Susan can live in the house for her entire life

- Susan can even rent it out and collect income

- BUT Susan cannot sell the fee simple—she can only sell her life estate interest

- When Susan dies, Tommy (the remainderman) automatically gets full ownership

- Tommy gets fee simple absolute—he can then sell, lease, or do whatever he wants

Why this matters: As a real estate agent, if Susan wants to sell "her house," you need to explain she can only sell a life estate, which is worth much less than fee simple. Most buyers won't want a house they'll lose when Susan dies!

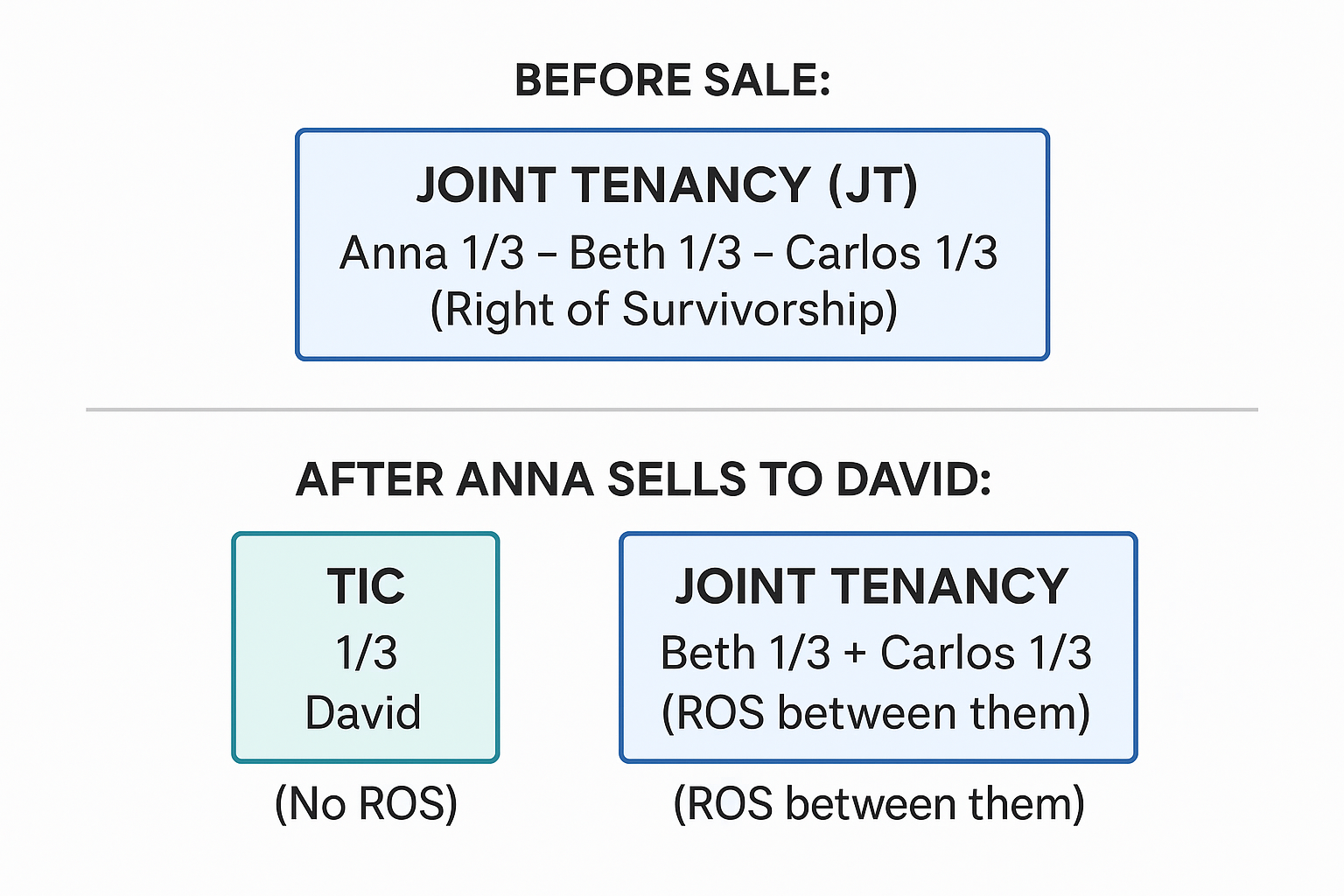

Example 2: Joint Tenancy Breaking

Scenario: Three siblings—Anna, Beth, and Carlos—inherit a beach house as joint tenants (each owns 1/3). Anna sells her share to David.

What happens?

- David is now a tenant in common (TIC) with 1/3 interest

- Beth and Carlos remain joint tenants with each other (they still share 2/3 total)

- The four unities (T-TIP) were broken for David—he acquired at a different time and by a different deed

- If Beth dies, her 1/3 goes to Carlos (right of survivorship), NOT to David

- Carlos would then own 2/3 as tenant in common with David's 1/3

View original ASCII

BEFORE SALE: ┌─────────────────────────────┐ │ JOINT TENANCY (JT) │ │ Anna 1/3 - Beth 1/3 - Carlos 1/3 │ │ (Right of Survivorship) │ └─────────────────────────────┘AFTER ANNA SELLS TO DAVID: ┌──────────────┐ ┌──────────────┐ │ TIC 1/3 │ │ JOINT TENANCY │ │ David │ │ Beth 1/3 + Carlos 1/3 │ │ (No ROS) │ │ (ROS between them) │ └──────────────┘ └──────────────┘

Example 3: Community Property vs. Separate Property

Scenario: Maria and John marry in 2015. Maria owned a condo before marriage (purchased 2010). During marriage (2018), they buy a house together. Maria inherits a rental property from her aunt in 2020.

Classification:

- Condo: Maria's separate property (acquired before marriage)

- House: Community property (acquired during marriage with community funds)

- Rental property: Maria's separate property (inheritance)

If they divorce:

- Maria keeps the condo and rental (separate property)

- The house is divided 50-50 (community property)

If John dies:

- Maria keeps her separate properties (condo and rental)

- John's 50% of the house goes per his will (or to Maria if no will)

💡 Real-World Tip: Community property can get complicated when separate property funds are mixed with community funds ("commingling"). This is why keeping clear records is essential!

Example 4: Tenancy in Common Shares

Scenario: Four investors buy an apartment building as tenants in common:

- Elena: 40% (invested $400,000)

- Frank: 30% (invested $300,000)

- Grace: 20% (invested $200,000)

- Henry: 10% (invested $100,000)

The building generates $100,000 in annual rental income.

Income Distribution:

- Elena receives: $40,000 (40%)

- Frank receives: $30,000 (30%)

- Grace receives: $20,000 (20%)

- Henry receives: $10,000 (10%)

If Grace dies:

- Her 20% goes to her heirs (children, per her will)

- Elena, Frank, and Henry continue owning their shares

- Grace's heirs become tenants in common with the others

If Frank wants to sell:

- Frank can sell his 30% share without permission from others

- Buyer becomes a tenant in common with remaining owners

- Other owners typically have no right of first refusal (unless previously agreed in writing)

Common Mistakes ⚠️

Mistake #1: Confusing "Severalty" with "Several Owners"

❌ Wrong thinking: "Severalty means several people own it" ✅ Correct: Severalty means ONE owner (severed from all others)

How to remember: Think "severed" = cut off from others = single owner

Mistake #2: Thinking Joint Tenants Can Have Unequal Shares

❌ Wrong: "Three joint tenants can own 50%, 30%, and 20%" ✅ Correct: Joint tenants MUST have equal shares (33.33%, 33.33%, 33.33% in this case)

If they want unequal shares, they must use tenancy in common.

Mistake #3: Assuming Community Property Has Right of Survivorship

❌ Wrong: "When my spouse dies, I automatically get everything because it's community property" ✅ Correct: Regular community property does NOT have automatic survivorship—the deceased spouse's 50% goes per their will

For automatic survivorship, you need community property WITH right of survivorship (must be stated in the deed).

Mistake #4: Forgetting That Life Tenants Can't Sell Fee Simple

❌ Wrong: "I have a life estate, so I can sell the property to anyone" ✅ Correct: A life tenant can only sell or mortgage their life estate interest, not fee simple

Why buyers care: A life estate becomes worthless when the life tenant dies. Most buyers want fee simple, not a temporary interest.

Mistake #5: Thinking Property Always Goes Through Probate

❌ Wrong: "All property goes through probate when someone dies" ✅ Correct: Property with right of survivorship (joint tenancy, community property with ROS) bypasses probate

Probate is the court process of distributing a deceased person's estate. It's time-consuming and expensive. Right of survivorship avoids it!

Key Takeaways 🎓

📋 Quick Reference Card: Property Ownership Essentials

| Concept | Key Points |

|---|---|

| Bundle of Rights | PECED: Possession, Enjoyment, Control, Exclusion, Disposition |

| Fee Simple Absolute | Highest form of ownership; perpetual; fully inheritable |

| Life Estate | Life tenant (ownership during life) → Remainderman (gets it after) |

| Severalty | ONE owner only (despite confusing name) |

| Tenancy in Common | Unequal shares OK; no survivorship; shares go to heirs |

| Joint Tenancy | T-TIP (four unities); equal shares; RIGHT OF SURVIVORSHIP |

| Community Property | California married couples; 50-50 split; acquired during marriage |

| Right of Survivorship | Property automatically goes to survivors; bypasses probate and wills |

🧠 Memory Devices:

- PECED = Bundle of Rights (Possession, Enjoyment, Control, Exclusion, Disposition)

- T-TIP = Four Unities for Joint Tenancy (Time, Title, Interest, Possession)

- Severalty = Severed from others = Single owner

- TIC = Tenancy In Common = Transfers to heIrs, Can be unequal

Did You Know? 🤔

Historical Fact: The concept of "fee simple" comes from feudal England. "Fee" comes from "fief" (land granted by a lord), and "simple" means it can be inherited by anyone (not just direct descendants). In medieval times, most land was held under complex feudal arrangements—fee simple absolute was actually rare!

California Quirk: California is one of only nine community property states in the U.S. This Spanish/Mexican legal tradition remained when California became a state in 1850. Most other states use "common law" property systems.

Practical Wisdom: Right of survivorship is often used to avoid probate, which in California can take 12-18 months and cost 4-8% of the estate value. A simple change in how title is held (adding "with right of survivorship") can save families tens of thousands of dollars and many months of court proceedings.

Try This! 🔧

Practice Exercise: Look at your own living situation (or imagine buying property):

- If you own property: How is title currently held? Look at your deed (county recorder's office has copies online).

- If you rent: What type of leasehold estate do you have? (Probably periodic tenancy if month-to-month, or estate for years if you signed a 1-year lease)

- Thought experiment: If you were buying investment property with two friends, would you choose tenancy in common or joint tenancy? Why?

Hint: Think about whether you want equal shares, whether you trust them completely, and who should get your share if you die.

📚 Further Study

For deeper understanding of California property law:

- California Department of Real Estate: Official CalBRE resources and reference books - https://www.dre.ca.gov/

- California Civil Code §§ 681-690: Statutory definitions of concurrent ownership types - https://leginfo.legislature.ca.gov/faces/codes.jsp

- California Probate Code § 5000-5032: Laws on community property and survivorship - https://leginfo.legislature.ca.gov/faces/codesTOCSelected.xhtml

You've completed Lesson 1! You now understand the fundamental types of property ownership and estates. These concepts will appear throughout your real estate career—in listing presentations, purchase contracts, probate sales, and estate planning discussions with clients. Next, you'll learn about encumbrances, easements, and restrictions on property rights. Keep going! 🚀